ACH Procedure

ODFI (Originating Depository Financial Institution)

General information:

- The Synctera platform creates ACH NACHA formatted files for exchange with the Fed (.ach formatted) with entries originated by the Originator

- Synctera follows the NACHA rules and restricts origination to WEB and CCD SEC codes. Originators can originate CREDIT and DEBIT entries after a successful receiver’s account verification process

- Originator’s customer and businesses go through a KYC and KYB process before being able to originate entries

- Originator’s customer and business are periodically screened for OFAC in the Synctera platform

- Receiver’s account or external accounts are verified via Plaid or Microdeposits

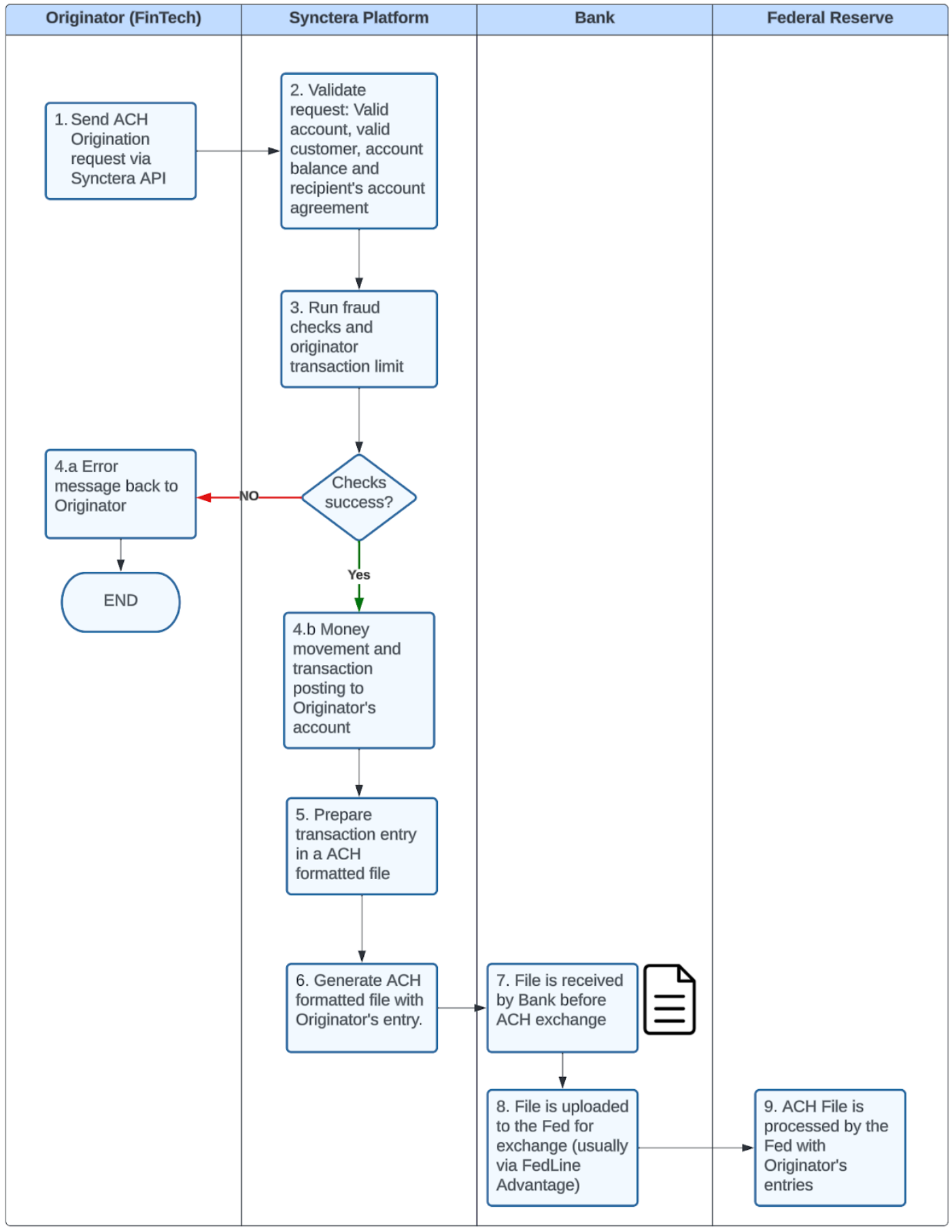

High level ACH Origination flow:

ACH Origination Prerequisites:

- In order to originate ACH DEBITS or CREDITS in the Synctera platform Originator’s customer or the business need to be KYC’d and/or KYB’d

- The Originator’s business or the customer needs to have a valid account in status ‘ACTIVE’ and ACH Origination needs to be enabled for that account

- In order to originate ACH DEBITS for consumers the FinTech customer must link the receiver’s account via Plaid using their banking credentials or if approved by the Bank to provide a proof of external account ownership i.e a void check

- For business customers, In order to originate ACH DEBITS and CREDITS to a different party they can only originate after obtaining an explicit ACH DEBIT Authorization from the receiver.

- The Originator requests the ACH Origination to the Synctera platform via API

- Originators can initiate Same day ACH entries and Non-same day entries through the Synctera platform. A same day / non same day option is provided to the Originator.

- The Synctera platform keeps track of the Fed working days to generate ACH files. ACH files only originated on business days.