Consumer onboarding

Step 1: Onboard a Person

In the Synctera platform, a person represents a natural person, including account holders, beneficial owners of a business and authorized signers. A person can hold multiple of these roles at the same time. Please see details in Synctera dev docs.Step 2: Record Disclosure Acceptance

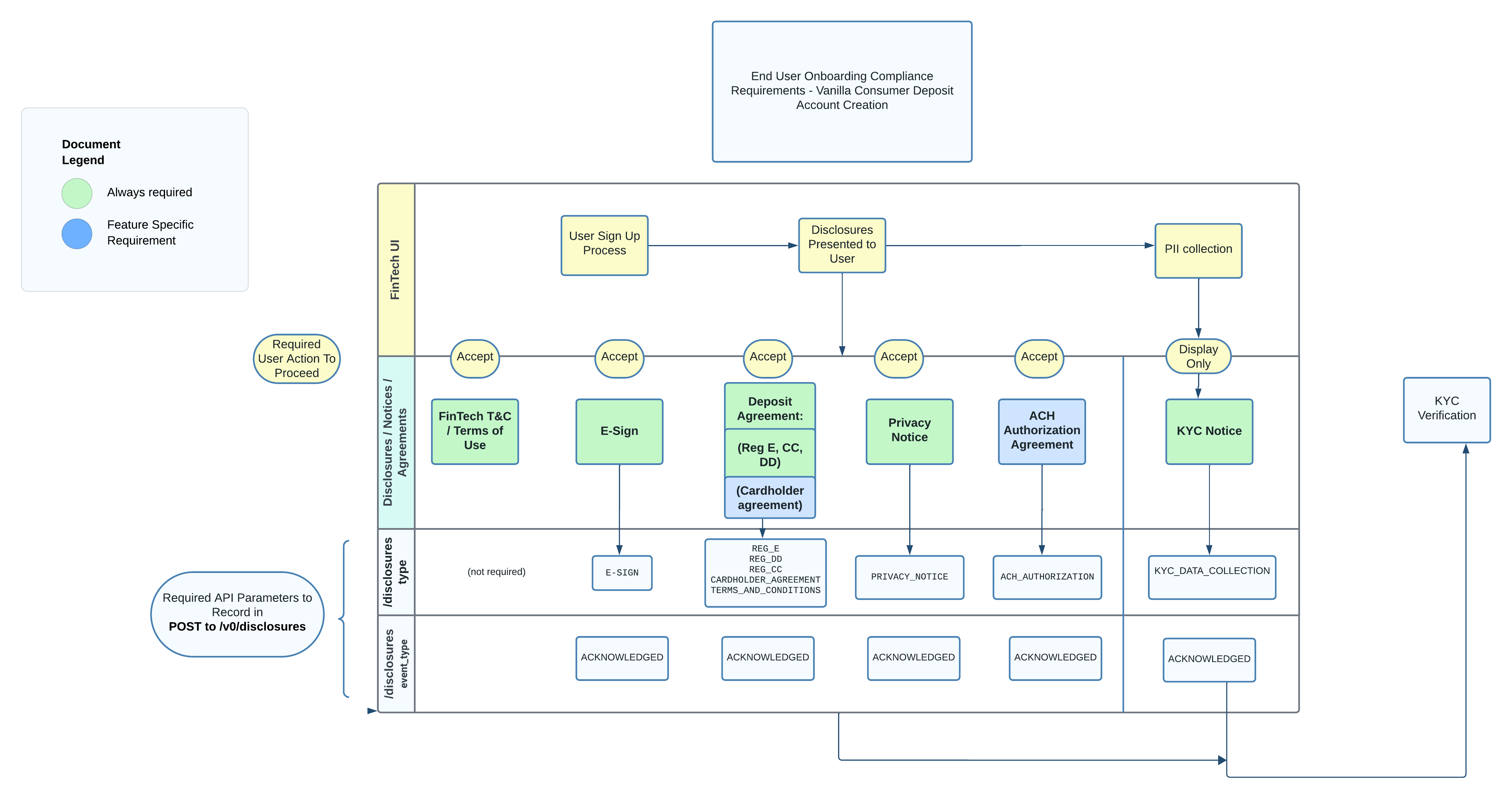

An important requirement when onboarding new customers is telling them about laws and regulations that affect them: that is, you must disclose that regulatory information. Please see details in Synctera dev docs.

Diagram: Disclosures

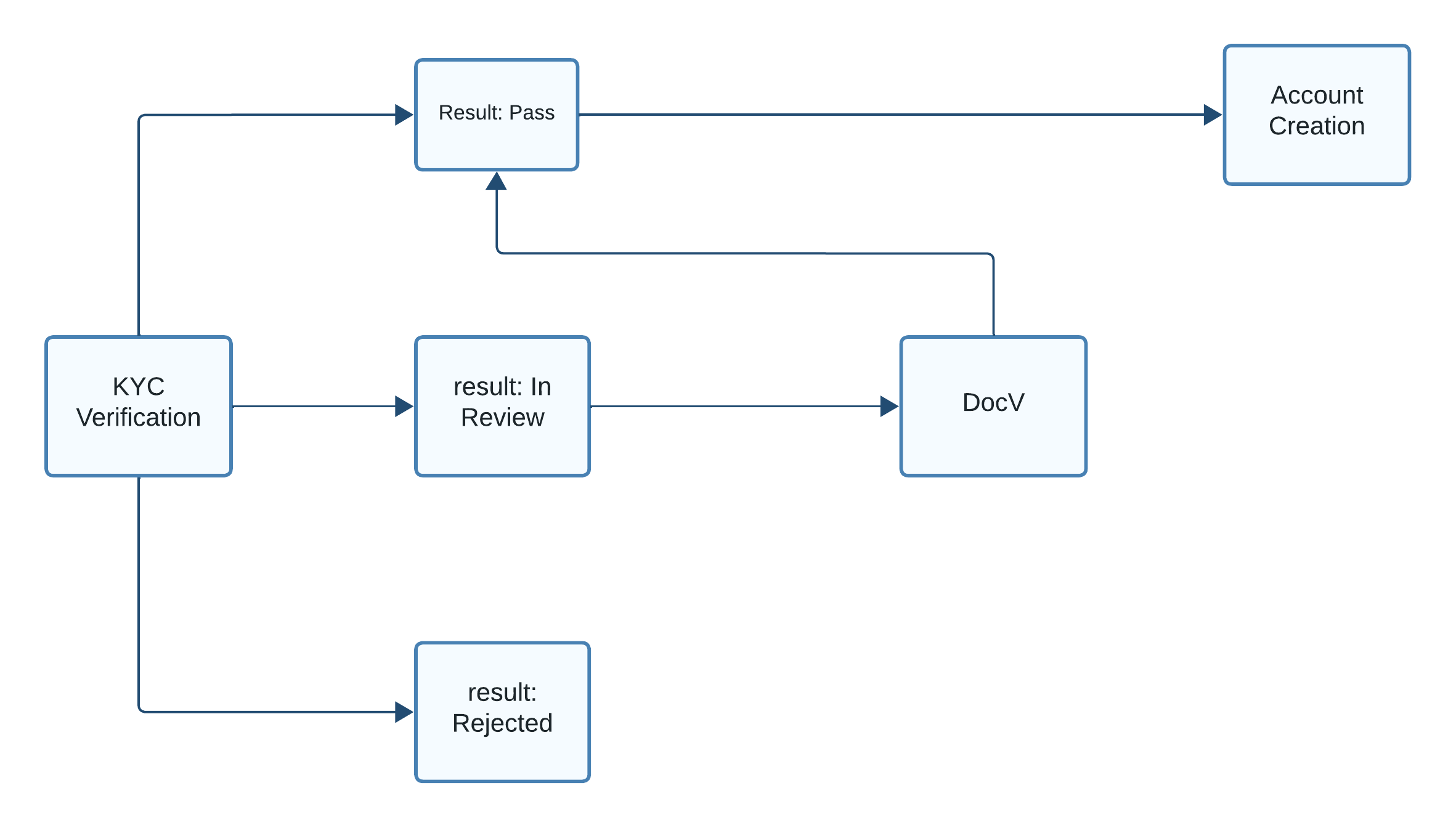

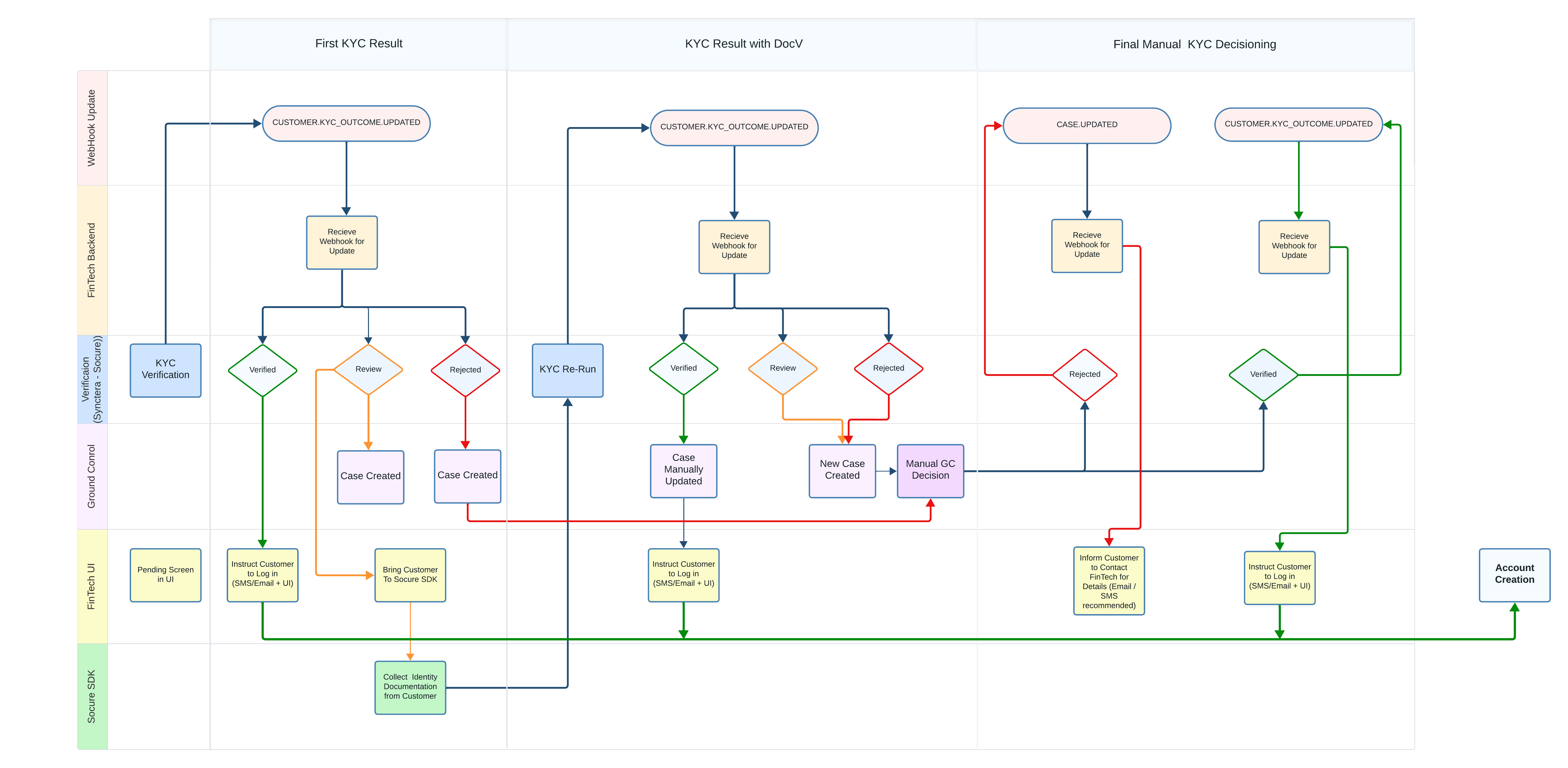

Step 3: KYC the Customer

US banking regulations require banks and other financial institutions to collect and verify information about the customers they do business with. These regulations require the establishment of a Customer Identification Program (CIP), commonly referred to as know your customer (KYC). These programs require:- Data Collection: name, date of birth, address, and government issued ID.

- Disclosures: notifying customers about the collection and retention of data.

- Verification: verifying that the information collected is current, valid, and up-to-date.

- On-going monitoring: verifying customer is not on a known watchlist.

RequirementsDocument Verification (DocV) is required for launch when customers go into KYC review status. Please see details in Synctera dev docs.

Diagram: KYC 1.1 (High-level Overview)

Diagram: KYC 1.2 (Detailed)

Sample text guide for KYC resultsSample text for KYC in review:

- TBD

- TBD