Synctera Instant Push to Card

Synctera offers InstantPush to Card as an alternative to other payment methods in your payment strategy. This is a convenient method that operates through existing card networks (Visa Direct and Mastercard MoneySend) to speed up funds delivery. This method offers 24/7/365 availability and allows customers to do an instant push of funds from their account to any payment card.Other names for Instant Push to CardThroughout the payments industry, this payment method is also known as an “Original Credit Transaction” (OCT) or an “instant disbursement”

Benefits

Adding Synctera Instant Push to Card to your payment stack enables you to:- Increase conversions: Make your financial product or FinTech app more attractive to potential customers with immediate access to funds

- Increase stickiness: Get customers using your product soon after signing up

- Increase customer satisfaction: Deliver real-time, convenient payment experiences to support growing customer demand

Use cases

- P2P transfers (requires FinTech to have an MSB license)

- Payroll direct deposits to facilitate instant earning access

- Funds disbursements, e.g. to enable fulfillment of insurance claims or tax refunds

- Instant bill payments

Considerations

Eligibility and supported scenarios

Current support:- Domestic transfers with Visa/Mastercard debit cards that are enabled for instant transfer services, which includes most debit cards

- Commercial and consumerdebit cards

- Cross-border transfers

- Transfers with credit cards

Cost/pricing

- Because you act as a merchant, you pay network fees

- Network fees are billed monthly

- You can add a markup / convenience fee for your customers

- Contact Synctera for detailed pricing

Limits

Network limits: Consumer cards| Consumer cards | |

| Per transaction | N/A |

| Daily limit per card | $10,000 |

| Business cards | |

| Per transaction | N/A |

| Daily limit per card | $10,000* |

| Program (Consumer or Business) | |

| Per transaction | Defined on FinTech Application with processor* |

| Daily aggregate | Defined on FinTech Application with processor* |

Other limitsVelocity limits may also be set by you and/or your sponsor bank. This is particularly important for use cases where the sender and recipient are different.

Risk management

With correct measures in place, instant push to card transactions are relatively secure. The following fraud prevention mechanism are utilized at different points in the instant transfer lifecycle to reduce fraud: During onboarding:- KYC/KYB on account holder(sender)

- Tokenization of card

- Address Verification Service (AVS) to verify cardholder address (address on card matches address on file)

- Cardholder name check (name on card matches name on file)

- For usecases where sender and recipient are different (me-to-you) -for increased account security and recipient authentication, we suggest that you add the following to your app/functionality:

- Recipient login/password to your app to provide card credentials

- Two-factor or multi-factor authentication, for example using text or email address on file, for recipient to authenticate before the push to card transaction is processed merchant before disbursement is processed.

- Check that customer (sender) and account are in good standing

- Limit checks

- Check fraud rules

- OFAC check

- Eligibility check

- Monitoring of account and transaction activity

- Anti-Money Laundering (AML) program

Chargebacks

- Not relevant as push to card transactions are considered final

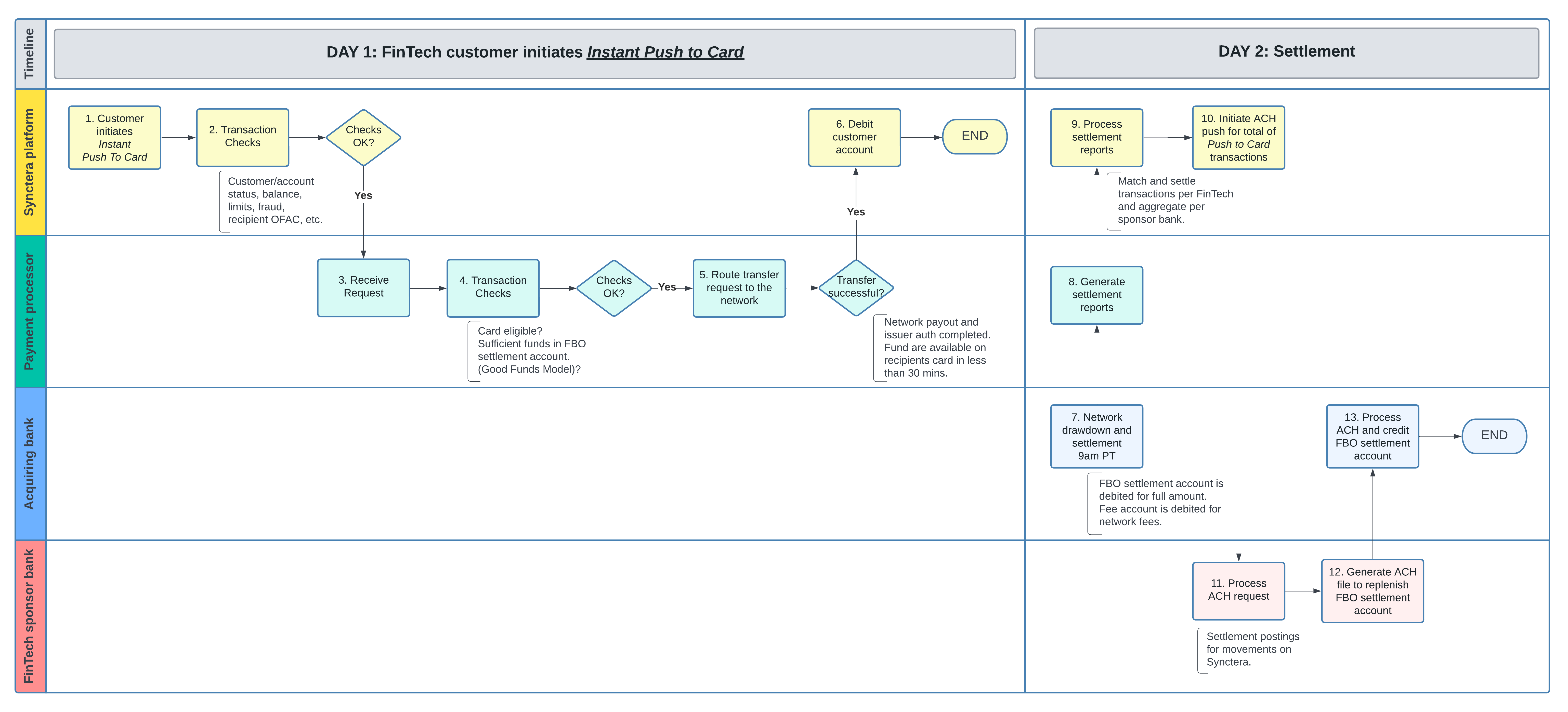

Flow of funds

Prerequisites:- FinTech customer (sender) has been onboarded on the Synctera platform and passed KYC/KYB

- Recipienthas successfully added/linked their external card

Funds for Instant Push to Card are collected from an FBO settlement account at the acquiring bank. You are required to prefund this account to eliminate any issues with the settlement the next morning (good funds model). Initially, prefund the account for at least your forecasted daily total amount of Instant Push to Card. The ACH push from Synctera (step 10 in the diagram above) will keep the account replenished. However, consider keeping additional funds to cover weekends and holidays.