Overview

Feature summary

- A cross-border transaction is a transaction where the merchant’s country code is different from the country code of the card BIN

- Cross-border transactions come with a cost to the FinTech

- Options for controlling cross-border transactions:

Feature details

Network fees

Mastercard:- Cross-border issuer fee = 90 bps on the transaction $ volume (Gross Merchandise Value - GMV)

- by default is NOT included in the amount requested from the cardholder

- The network bills this fee to the issuer weekly, and Synctera passes this fee through to the FinTech monthly

- Currency conversion user fee = 20 bps on the transaction $ volume (GMV):

- The estimated fee is by default included in the amount requested from the cardholder

- The actual fee comes through in the daily settlement from the network - occasionally, there is a minor difference between the estimated and the actual fee, resulting in an FX adjustment, which is, by default, also covered by the FinTech

- Cross-border issuer fee = 100 bps on the transaction $ volume (GMV)

- by default is NOT included in the amount requested from the cardholder

- The network bills this fee to the issuer daily, and Synctera passes this fee through to the FinTech monthly

Identification of a cross-border transaction:

- A cross-border transaction is identified in the transaction API, in the authorization gateway, in the Synctera Console and in Synctera Insights

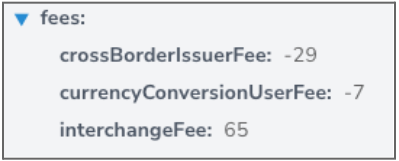

- Transaction API:

- When applicable, cross-border fees would be shown under under user_data.fees:

- Conditions for identifying when cross-border fees apply:

Plain text

- Authorization gateway:

- Conditions for identifying when cross-border fees apply:

Plain text

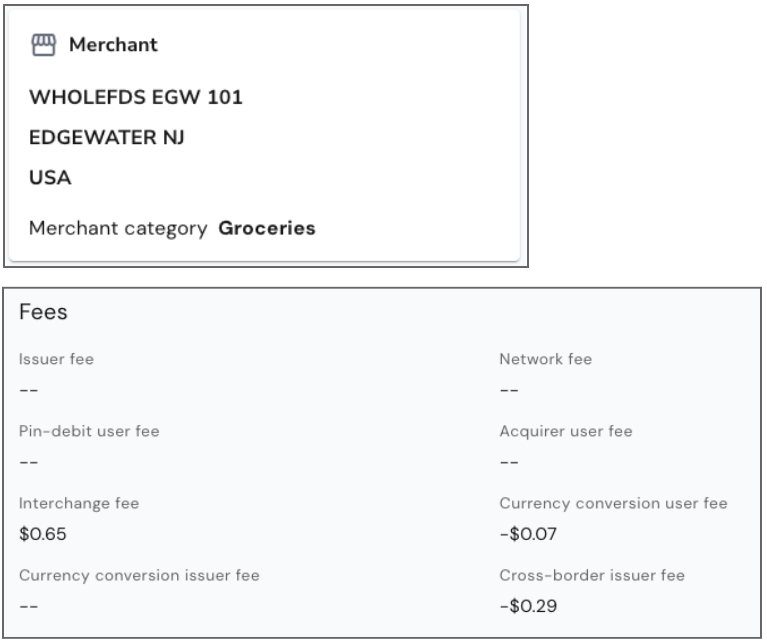

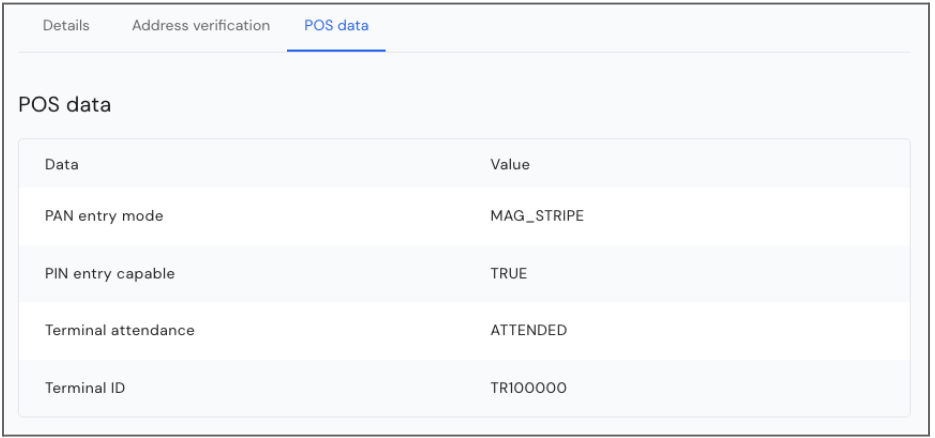

- Synctera Console (UI):

- Card Transaction Details > Details (Merchant Country Code / Fees):

- Card Transaction Details > POS data (Country, if available):

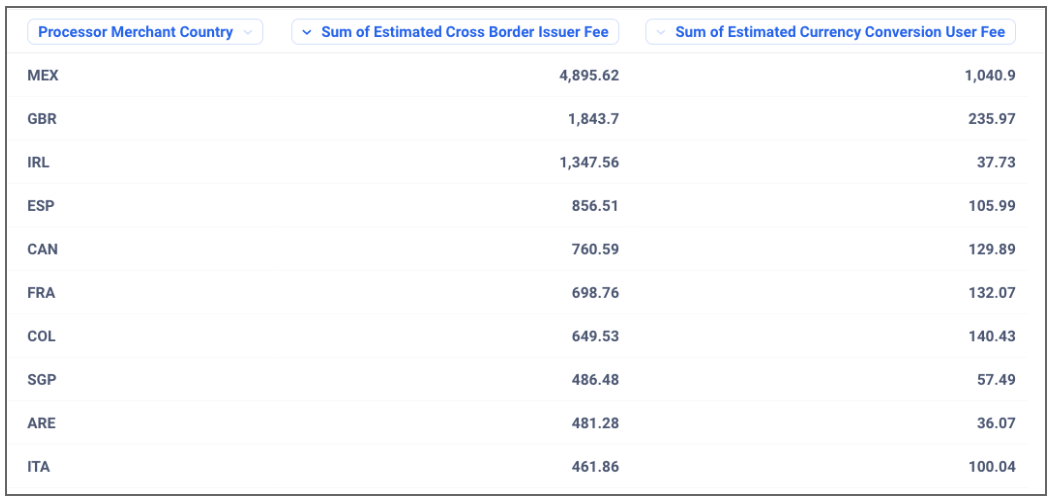

- Synctera Insights:

- FinTechs can build their own reports based on the Card Transactions Extended Metadata view contained within the Card Reference Dashboard. This view contains the:

- Processor Estimated Cross Border Issuer Fee

- Processor Estimated Currency Conversion User Fee (already part of amount requested from cardholder)

- Example - sum of Estimated Cross Border Issuer Fee and Estimated Currency Conversion User Fee by Merchant Country:

Implementation of controls

Option a: Allow cardholders to approve cross-border transactions and charge a minimum fee

- Reject cross-border transactions by default, but allow the cardholder to approve, across all merchants, specific merchants or per-transaction, with the acceptance of a fee being added (minimum of 2% to be inline with the market).

- Implementation effort:

- FinTech uses the authorization gateway to decline or accept the transactions, based on own rules/framework to allow the cardholder to accept

Option b: Pass fees directly to cardholders

- Charge cardholders a foreign transaction fee when a cross-border transaction is posted:

- The recommended fee is a minimum of 2% for all cross-border transactions up to a maximum of 3% to ensure FinTech is covering the cross-border and FX adjustment costs and earning revenue from these transactions

- Implementation effort:

- A new internal account must be created for this use case - FinTech can contact their Synctera implementation or CS representative for help getting this account setup

- FinTech uses the Fees API to create and post the fee:

- Create a fee template with subtype FOREIGN_TRANSACTION, and an internal fee account. Note that the fee template has a fixed amount, but each fee can override that. We recommend that you use metadata to reference the cross-border transaction to which the fee applies.

- Post the fee using the Create Fee endpoint, and make sure to override the fixed amount with the actual amount (see recommended percentage below).

- FinTech could include the fee in the validation of available balance in the authorization gateway to reduce the likelihood of the cardholder going into negative balance.

- Timing of the posting: listen to the “posted” webhook for the transaction to trigger the fee.

Option c: Disable cross-border transactions

- Disable cross-border transactions at the card product level to automatically decline all cross-border transactions.

- This will be the default option for new card products

- Implementation effort:

- None - this setting is controlled by Synctera on the card product level. FinTechs can contact their Synctera implementation representative for this setting.

Option d: Absorb the fee as a benefit of the program

- Continue to accept and process cross-border transactions and consume the fees on behalf of cardholders

- Implementation effort:

- None

- As an alternative, absorb some of the fees and pass the remainder onto the cardholder as a program benefit (e.g. charge the cardholder 1% of the fee, and absorb the rest).

- Implementation effort:

- Same as for option b

Option e: Educate cardholders to sign up for or switch to merchant accounts registered in the BIN issuing country

- Based on observed usage, educate cardholders on how/when to use the card.

- For example, some merchants route their transactions through their cross-border entities for various reasons.

- The transaction can be initiated in USD, and the card can be in USD, but if the merchants themselves are in the GBR, the cross-border rules apply.

- If the card was issued in the US, and the business/cardholder is signed up to a merchant with their non-US merchant account and address, or via a non-US merchant location, the business/cardholder could:

- establish merchant account based in the US

- contact the merchant directly and ask for all transactions to be processed in USD (some merchants provide this service upon request)

- Implementation effort:

- None

Compliance considerations

- If cross-border transactions are enabled on the card product and: a. FinTech wants the ability to decline a transaction in the authorization gateway based on their own business rules, it needs to be disclosed in the account agreement. b. FinTech charges customers a foreign transaction fee, the fee details must be disclosed in the account and cardholder agreements.

- If cross-border transactions are disabled on the card product, they must be disclosed in the account agreement.

- Creating a case to alert the bank/Synctera Compliance about your selected option for cross-border fees

- Compliance and banks need to sign off on fee and the appropriate disclosures

- Wait for approval and update disclosures