Introduction to internal accounts

When looking at a Fintech in BaaS, the Synctera ledger is considered a FinTech centric subledger. From an accounting perspective, a FinTech program is defined as the unique combination between a bank and a Fintech. Each Fintech program has accounts of the Fintech’s end customers (“customer accounts”). These accounts roll up into one or many FBO or Loan GL accounts on a per program level depending on the balance sheet position to which the customer accounts need to aggregate to. In addition, each program by nature has to balance from a double sided book keeping and requires accounts that are non customer accounts. These non customer accounts can be considered the GL accounts of the program (“internal accounts”) and the balances in these accounts are within the program and therefore roll up into FBO accounts on a bank level. The nature of these balances is different and mostly temporary. Therefore these internal accounts roll up into different FBO accounts on a bank level and will ultimately be assigned to different balance sheet positions in the bank’s balance sheet.Types of internal accounts

The Synctera platform differentiates the following internal accounts and account types:| Type | Description | Example(s) |

|---|---|---|

| Settlement Accounts | There is 1 account per payment rail (ACH, Domestic Wires, Card, AFT) to facilitate the daily sweep of settled funds and the timing difference between the bank’s end of day and the payment rails cut-off dates. | ACH settlement account Card settlement account AFT settlement account OCT settlement account Wire settlement account |

| P&L Accounts | There are money movements between the Fintech and its customers. Examples are interest paid or charged, fees charged, rewards given, losses due to Fraud, etc. The level or granularity of these accounts should reflect the level of granularity that a Fintech would need in order to properly add the balances / transactions to it’s own P&L, since all balances of the accounts influence the P&L of the FinTech | Fraud losses Interest paid Interest charged Rewards paid |

| Suspense Accounts | Suspense accounts are a necessary evil to process payments that cannot be posted directly to the customer account since these accounts are not available for posting due account freezes, account closures or payments to accounts that don’t exist | ACH Suspense Wire Suspense |

| Reserve Accounts | These accounts are used as reserves for negative balances and fraud, support for overnight float and reserve for asset repurchases on lending programs | General Reserve Repurchase Reserve |

| Treasury Accounts | Treasury accounts are used to reflect secondary postings that might involve reserves but can also be used to track balances that might in the future impact the Fintech’s P&L or balance sheet. The can be considered accrual or provision accounts | **Repurchased assets Reserve in use ** |

| Core Accounts | Each program must balance on a debit and credit side. At the end of each day, the confirmed money movements from the banks will be used to sweep the settlement, reserve and P&L accounts. Currently, only the money-in-and-out account is a core account. If all funds were at rest, this account would display the FBO balance | Money-in-and-out FBO Transfer Account |

Mapping to the Bank’s core ledger

Equivalents of Internal accounts on the bank’s core ledger:| Program Accounts on Core Ledger | Description and Balance Sheet Position Assignment at the Sponsor Bank |

|---|---|

| FBO account / Loan GL | Depending on the Core system, FBO accounts can be DDA accounts or GL accounts. The decision is up to each sponsor bank. Only condition is that these accounts can be posted to via ACH to update the balances at the end of each business day. FBO accounts fall typically in balance position of assets (lending programs) or liabilities (deposit programs) |

| Reserve Account(s) | Reserve accounts should be DDA accounts or GL accounts that can be posted to via ACH. These accounts represent liabilities towards the Fintech. |

| Repurchasing Reserve | Reserve accounts should be DDA accounts or GL accounts that can be posted to via ACH. These accounts represent liabilities towards the Fintech, specifically for the purpose of repurchasing assets |

| Repurchased Assets | Repurchased Asset accounts represent an offset to lending GLs. They have to be assigned to the same balance sheet position as the loan GL where the assets are rolled up. The difference between the loan GL and the repurchased assets represents the remaining asset balance with the sponsor bank |

| Adjustment account | The adjustment account can take on an asset or liability position. It reflects the money owed either by the FiNtech to the program or vise versa. It is the roll up of the P&L accounts of the program. By rolling all internal P&L accounts up into 1 adjustment account, the bank allows for freedom of P&L structure for the Fintech without having to open new program accounts for this. |

| Settlement Accounts | Settlement accounts are transient accounts that hold the amount of cash in transit that might be charged to the customer and has not settled or cash that has settled but has not yet reached the customer’s account. It is mainly there for account for timing differences between the settlement windows of the networks and the customer interaction. There should be 1 settlement account per payment rail for easier reconciliation |

Secondary postings

The Synctera ledger creates secondary posting as a result of a customer transactions. These postings are typically for reserve or treasury purposes and don’t affect the customer account at the time. Examples of secondary postings are:- Forced ACH return debit that pushes a customer’s deposit account into a negative balance

- For the amount of the negative balance, a secondary posting would be made to debit the reserve account and credit a allocated reserve account.

- Should the negative balance clear with other postings, the allocated reserve will be automatically posted back

- Should the negative balance be written off, the write of will debit the allocated reservce and credit the customer account which now can be closed

- In a lending program, whenever a line of credit is disbursed or paid back and the Fintech has an agreed buy-back ration of 95%

- When money is disbursed, 95% of the amount will also be debiting the repurchase reserve and crediting the repurchased asset account.

- When transferring this to the program accounts and the balance sheet of the bank, the repurchase account will reduce the liabilities towards the Fintech (it’s a prefunded account) and the repurchased asset account will be an offset to the asset side of the bank

End of day processing

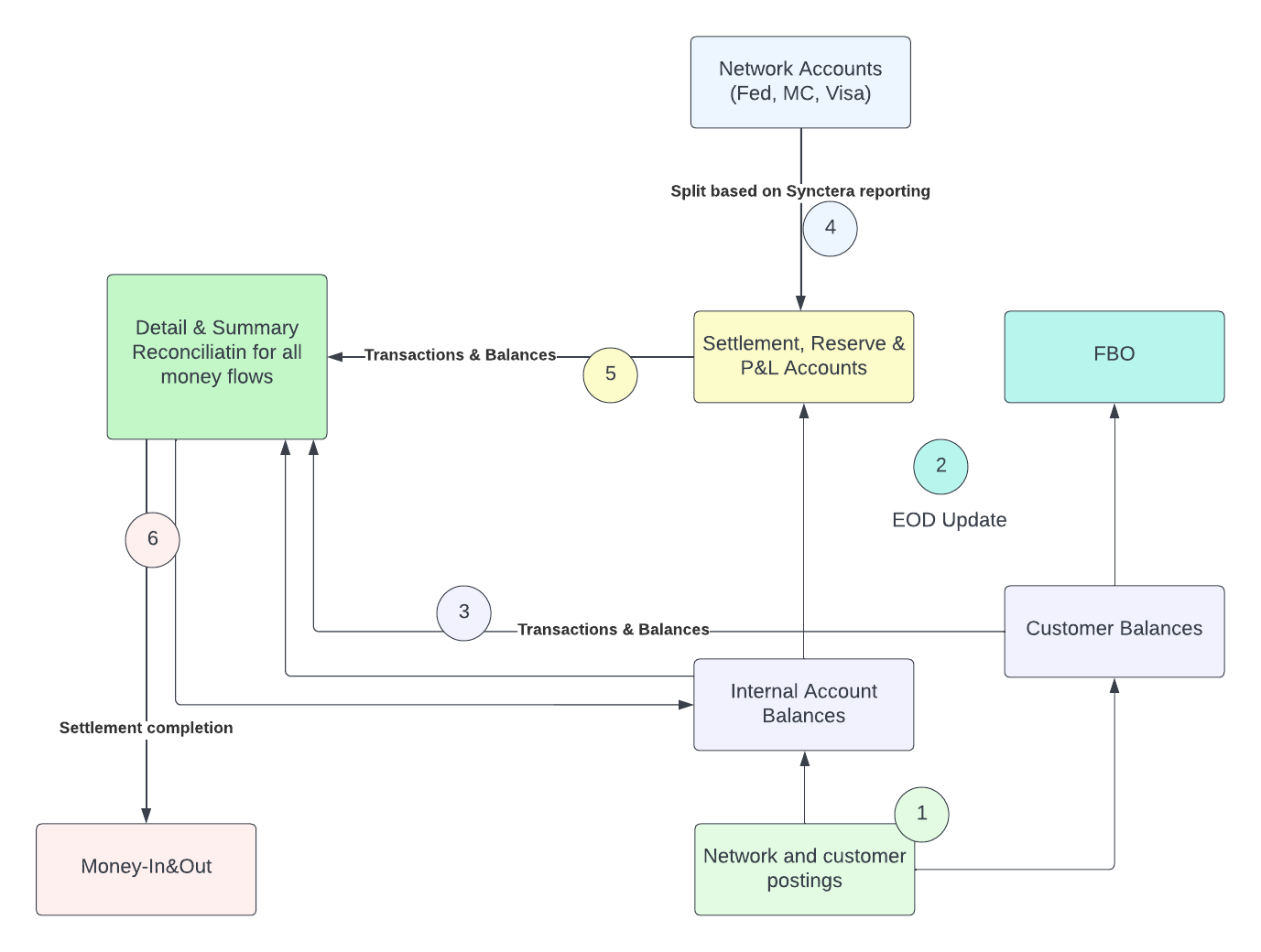

- Networks and Customers instruct transactions by using their cards or by using the Fintech’s app to transfer money, fund their accounts, mRDC checks, etc.

- This is controlled by Synctera and the Fintech

- At the end of the bank business day, a time mutually agreed between the sponsor bank and Synctera, Synctera will increase the transactional posting date. This happens every day, not just every bank business day. Synctera will now prepare the end of day FBO updated files as separate ACH files and SFTP these files to the sponsor bank

- Currently Synctera does not yet issue the files (coming in Q4/2022)

- Sponsor Bank would use Synctera Money Movement report to make the postings from the respective accounts to the FBO account

- When Automatic FBO Transfer functionality is complete, the bank has to ingest the FBO transfer .csv file(s) to update the respective balances. The FBO transfer .csv files are balanced files

- The Synctera ledger will transmit all transactions and balances to the reconciliation platform

- This is automated by Synctera

- The networks will settle intra day or next day with the bank. Initially, the Sponsor banks will have to use Synctera reports to split the settlements and post the amounts to the payment rail specific settlement account of each FinTech

- Synctera provides a Settlement Report that allows the bank to make the respective postings

- Synctera will provide automatic .csv Network Distribution files by end of Q4/2022

- Synctera will ingest the balances and transactions of all program accounts from the sponsor bank

- Bank will provide daily files containing the balances and transactions for all program accounts

- Synctera will close the reconciliation loop and post all money that was received into the program or that has left the program in its own ledger based on the movements in the sponsor bank

- Synctera will automate this in Q4/2022

- This is done by Synctera Payments Ops team

Fund flow and timing on internal accounts

FBO transfer - Posting scheme and responsible parties

Settlement accounts

Customer is using their Debit Card and spend $100. Synctera Ledger| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 1 | Customer Account | 100 | D | Card Settlement | 100 | C | Posting is initiated via API on the Synctera platform. Synctera will create an ACH file for the bank to push into the network Happens throughout the day | |

| 2 | FBO Transfer | 100 | D | FBO Transfer Offset | 100 | C | FBO Transfer will move money, in this case the balance of the Card Settlement Account. The Amount in the File is a C to the Card settlement account on the Bank’s ledger Happens at the end of bank sponsors posting day | |

| 3 | FBO Transfer Offset | 100 | D | FBO Transfer | 100 | C | Amount in the File is a D to the FBO account on the Bank’s ledger Happens at the end of bank sponsors posting day |

| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 3 | FBO | 100 | D | Card Settlement | 100 | C | The .csv FBO transfer files are D/C balanced and will update all program accounts in the banks ledger on a daily basis Happens at the end of bank sponsors posting day | |

| 4 | Card Settlement | 100 | D | MC Drawdown Account Interchange | 95 5 | C C | (this happens normally during the course of the next business day) The network is drawing the amount of spend netted by the interchange from the Sponsor Bank |

| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 5 | Card Settlement | 100 | D | Money-in-and-out | 100 | C | Done manually on the Synctera platform at the beginning of day, once the files from the sponsor banks were received | |

| 6 | Money-in-and-out | 5 | D | Interchange | 5 | C | Done manually on the Synctera platform at the beginning of day, once the files from the sponsor banks were received |

P&L Accounts

Customer receives $3 interest at the end of the period Synctera Ledger| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 1 | Interest Paid | 3 | D | Customer Account | 3 | C | Interest Credit happens after the transactional processing for the day is closed but before the FBO Transfer The FBO transfer therefore takes the interest paid into consideration | |

| 2 | FBO Transfer Offset | 3 | D | FBO Transfer | 3 | C | FBO Transfer will move money, in this case the balance of the Interest Paid Account. The Amount in the File is a C to the FBO on the Bank’s ledger Happens at the end of bank sponsors posting day | |

| 3 | FBO Transfer | 3 | D | FBO Transfer Offset | 3 | C | Amount in the File is a D to the P&L Adjustment account on the Bank’s ledger Happens at the end of bank sponsors posting day |

| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 3 | P&L Adjustment | 3 | D | FBO | 3 | C | The .csv FBO transfer files are D/C balanced and will update all program accounts in the banks ledger on a daily basis Happens at the end of bank sponsors posting day | |

| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 5 | Money-in-and-out | 3 | D | Interest Paid | 3 | C | Done manually on the Synctera platform at the beginning of day, once the files from the sponsor banks were received |

Suspense Accounts

Suspense Accounts are “instead of customer accounts” and therefore will not be transferred in the FBO Transfer. The offsetting posting for all suspense accounts is an internal settlement accountReserve Accounts

Customer has a forced overdrawal on a checking account for $10. The actual customer transaction is not shown below, only the secondary postings. Synctera Ledger| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 1 | Reserve | 10 | D | Allocated Reserve | 10 | C | This happens when the overdraft happens | |

| 2 | FBO Transfer Offset | 10 | D | FBO Transfer | 10 | C | FBO Transfer will move money, in this case the balance of the Reserve Account. The Amount in the File is a C to the Allocated Reservce account on the Bank’s ledger Happens at the end of bank sponsors posting day | |

| 3 | FBO Transfer | 10 | D | FBO Transfer Offset | 10 | C | Amount in the File is a D to the Reserve account on the Bank’s ledger Happens at the end of bank sponsors posting day |

| # | Account | $$ | D | Account | $$ | C | Comment | |

|---|---|---|---|---|---|---|---|---|

| 3 | Reserve | 10 | D | Allocated Reserve | 10 | C | The .csv FBO transfer files are D/C balanced and will update all program accounts in the banks ledger on a daily basis Happens at the end of bank sponsors posting day | |

Treasury accounts

Treasury Accounts are also secondary accounts are an treated like Reserve Accounts.Core accounts

Core Accounts do only exist in Synctera’s Ledger and are not transferred to the bank’s ledger.FBO Transfer - Transaction Types and Granularity

Transaction types

Each movement in Synctera will have its own transaction types and addenda information that is provided in the files. Here is the list of transaction types:- FBO Transfer (Debit) - addenda specifies which Account is Transferred

- FBO Transfer (Credit) - addenda specifies which Account is Transferred

- ACH Settlement (Debit)

- ACH Settlement (Credit)

- Wire Settlement (Debit)

- Wire Settlement (Credit)

- ICL Settlement (Debit)

- ICL Settlement (Credit)

- AFT/OCT Settlement (Debit)

- AFT/OCT Settlement (Credit)

- P&L Settlement(Debit)

- P&L Settlement(Credit)