Introduction

This is a convenient method that operates through existing card networks (Visa Direct and Mastercard MoneySend) to speed up funds delivery. This method offers 24/7/365 availability and allows customers to: 1) ‘pull’ funds from their payment card to instantly fund their account or 2) do an instant‘push’ of funds from their account to any payment card.Other names for Instant Account Funding and Instant Push to Card Throughout the payments industry, Instant Account Funding is also known as an “Account Funding Transaction” (AFT) or an “instant purchase”. Instant Push to Card is also known as an “Original Credit Transaction” (OCT) or an “instant disbursement”.

Benefits and use cases

For benefits and use cases for each payment method, follow the links below:Instant Account Funding

Neque porro quisquam est qui dolorem ipsum quia dolor sit amet

Instant Push to Card

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Considerations

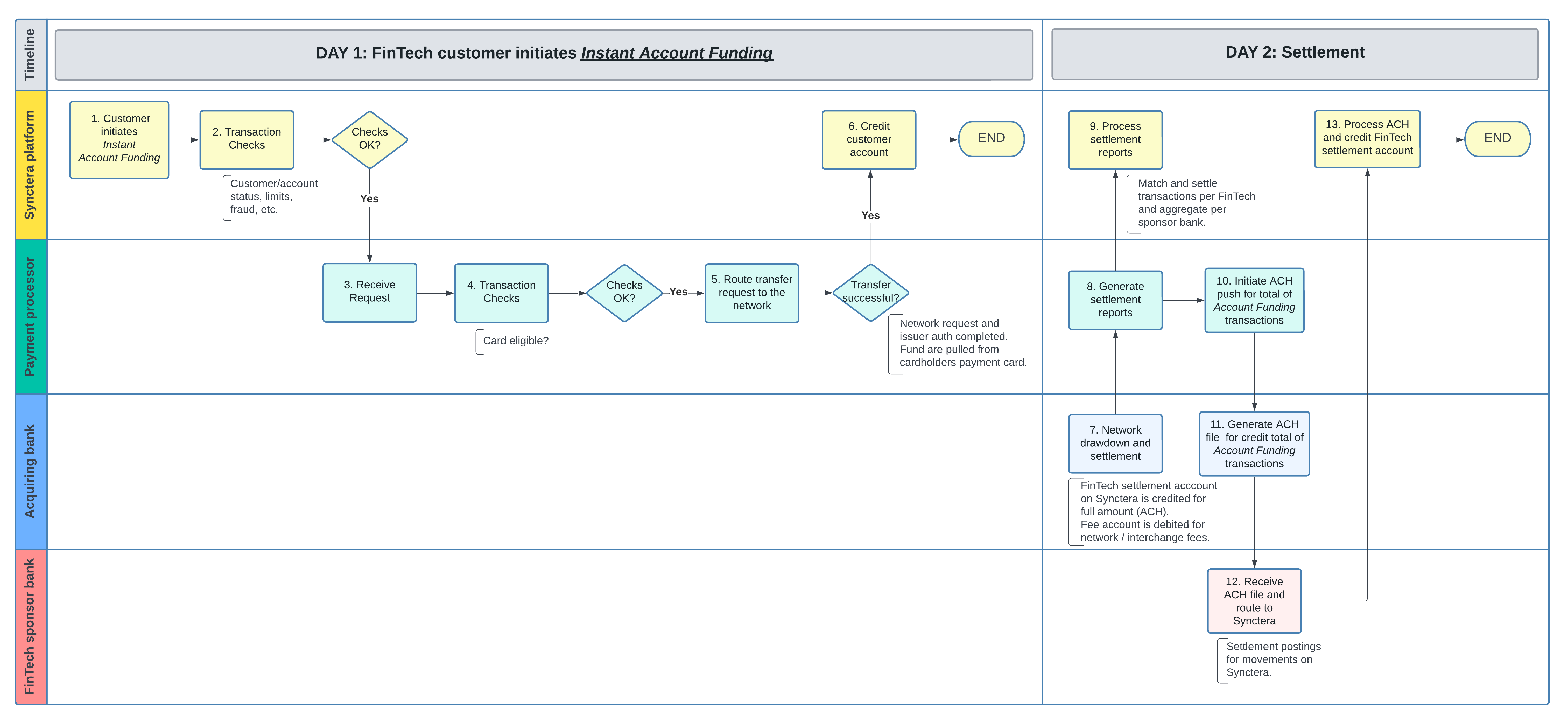

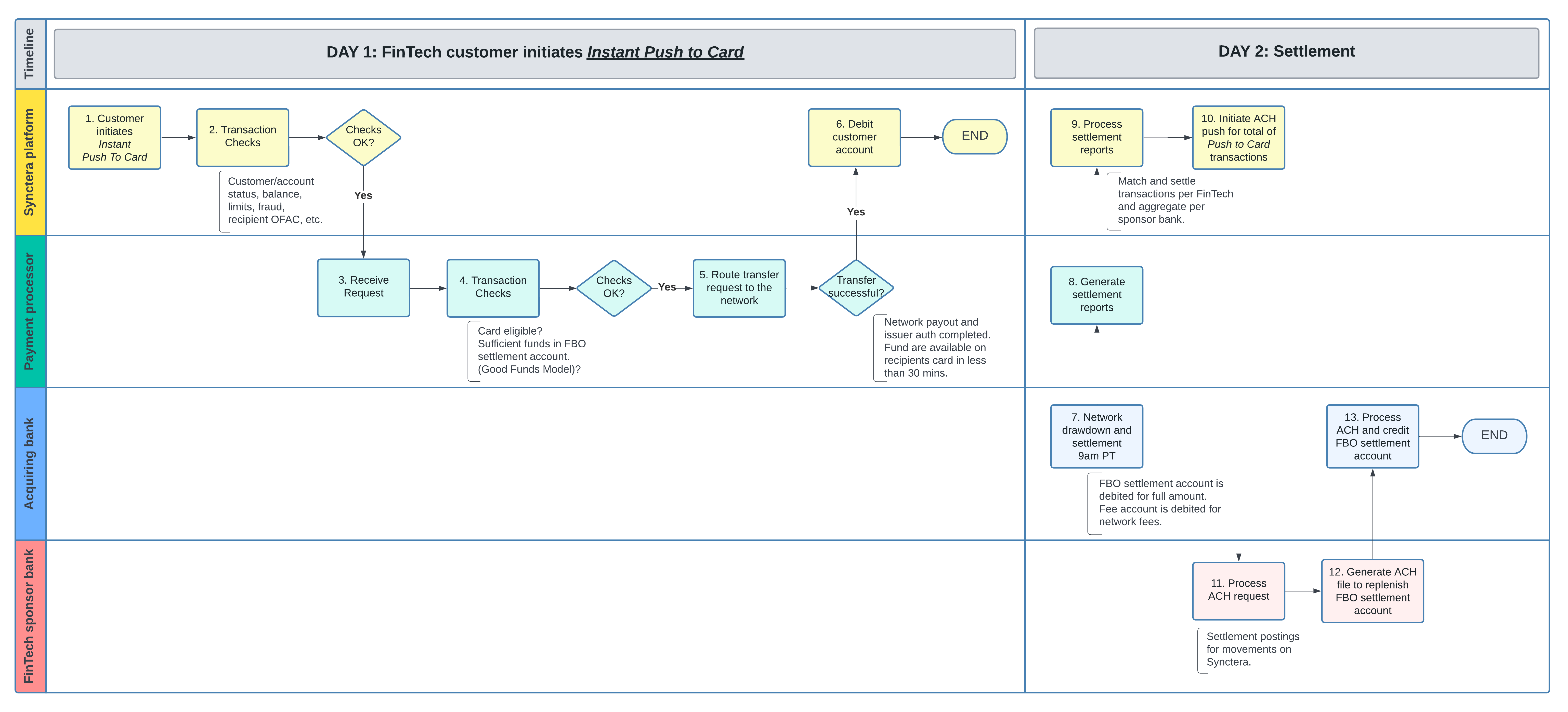

Flow of funds

Prerequisites:- FinTech customer has been onboarded on the Synctera platform and passed KYC/KYB

- FinTech customer has successfully added/linked their external card

For awareness:End-of-Day between Synctera and the FinTech sponsor bank, you, is not shown in the above diagrams. This would include:

- Balancing of FinTech AFT/OCT Settlement Account - this is an account that Synctera will request to be setup for the FinTech on your platform

- Balancing of FinTech FBO

- Balancing of ACH Settlement Account - if not already done for ACH movements throughout the day

Risk management

The FinTech sponsor bank’s role in the process of Instant Account Funding and Instant Push to Card is primarily to facilitate movement of ACH payments between the Synctera platform and the payment processor / acquiring bank for daily settlement. However, there are some risk factors for the bank to consider. These risk factors are discussed below.Impact of transfers on FinTech’s risk profile

Instant Account Funding: As shown in the flow of funds diagram above for Instant Account Funding, the FinTech customer account is funded immediately, whereas the sponsor bank receives the funds at settlement on day 2. This introduces a liquidity risk for your bank, and you may want to request additional reserves from the FinTech to mitigate this risk. For example:- At the start of the program, request 100% coverage for the average daily total of Transfers from Card for one (or more days to cover weekends and holidays - settlement only occurs on business days).

- Monitor the payment behavior - the percentage of funds that stays in the account. As the percentage of funds that are being withdrawn immediately goes down, you might want to consider easing the requirements. For example, request 30-50% coverage, or offer other less strict options that may be viable for both the FinTech and the bank.

Other factors to consider

During onboarding:- KYC/KYB on account holder

- Tokenization of card

- Address Verification Service (AVS) to verify cardholder address (address on card matches address on file)

- Cardholder name check (name on card matches name on file)

- Check that customer and account are in good standing

- Limit checks:

- The networks set daily limits per card at $10,000

- Additional velocity limits may also be set by you and/or by the FinTech

- Check fraud rules

- [Coming soon] EVM 3DS (added layer of cardholder authentication):

- OFAC check (if required for use case)

- Eligibility check

- Monitoring of account and transaction activity

- Anti-Money Laundering (AML) program