Introduction

Synctera will begin with a rule-based monitoring system by partnering with a transaction monitoring solution provider which includes a default rule set. The default rule set can be configurable and customizable according to your program’s risk appetite during pre-launch and post-launch with the bank’s approval. Following the necessary steps below will ensure a smooth and collaborative alignment on the rules strategy process:Pre-Launch Fraud Rules Strategy Process:

During implementation, there are several steps to ensure your program will launch with the appropriate rule configuration(s).- The initial fraud strategy meeting with Synctera’s compliance operations team is scheduled with assistance from an I&O team member (~30 min meeting).

- The initial fraud strategy meeting may consist of a fraud presentation and high-level overview of the rules strategy document.

- Synctera’s Compliance Operations team will share the fraud rules strategy document with your team for review and feedback (Please allow 2-3 business days).

- Synctera Compliance Operations team will respond to the feedback and/or questions within the document (Please allow 3-5 business days for response)

- Synctera will schedule a follow-up meeting for any questions/feedback on any outstanding fraud rule(s) if necessary (~30-45 min meeting).

- Synctera will share a final version of the rules strategy document for your review and confirmation. (Please allow 2-3 business days for final version)

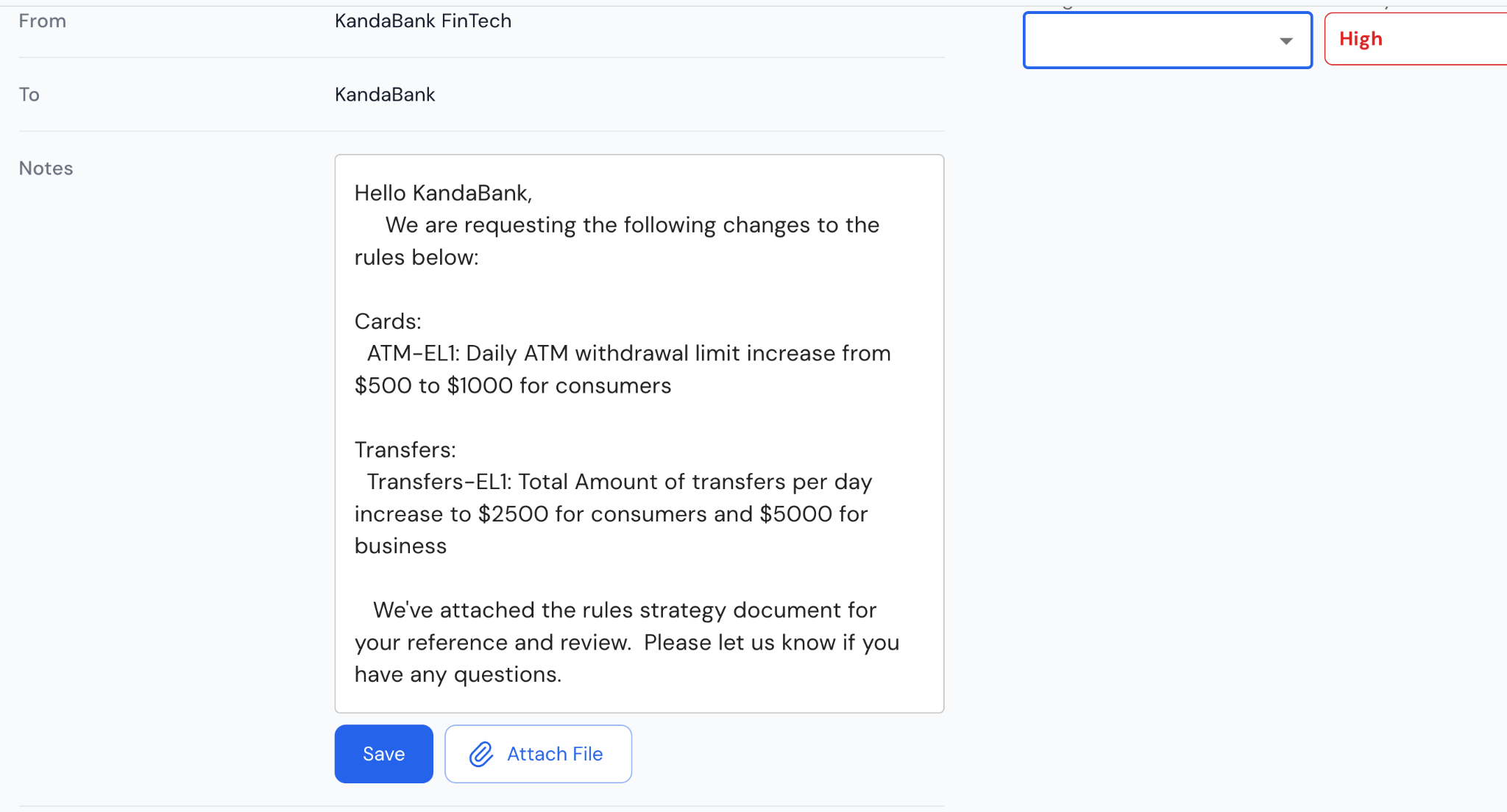

- Upon confirmation, Synctera will submit an approval request to the bank via the information request case on your behalf:

- Purpose of request

- Hard limits approval request

- Per payment type (e.g. ACH, wires, debit card, smartcard)

- Duration (e.g. daily limit for cards)

- Customer type (consumer/business) if applicable

- Amount/Count

- A copy of complete list of the fraud rules strategy

- The case will be submitted to the bank for approval

- Bank approval is dependent on the rule changes and resources.

- After bank approval, the applicable approved rule modification(s) is then configured, tested and published in the production environment by a member of the Compliance Operations team.

- The completion of the rule configuration(s) will be communicated to the FinTech via the submitted information request case and other applicable communication channels

- The information request case will be marked as “complete”.

Post-Launch (Approval Request)

Rules/limit changes can be made at any time during the life of your program. Similar to the pre-launch process, it is critical that the following processes are adhered to in order to have a smooth and successful implementation of the rule changes. Please submit an Information Request case to the bank within Synctera’s UI with the following information (Please see Synctera’s learn site on step-by-step process on how to create an information request case)- Hard Limit Change Request (e.g. Daily card spend increase from 3000)

- Reason for change request (e.g. the daily average activity of all users have been ~$2500 and there have been a large number of false positive cases due to the current default limit)

- Case example (if applicable)

- Brief summary of the purpose of the future transaction (e.g. user wants to transfer $51,000 to their BOA account to purchase a vehicle)

- Link to the user’s profile (this can be found in the url within the UI)

- Date of future transaction

- Originating account

- Beneficiary account (if applicable)

- Supporting documents, if applicable (e.g. invoice, statement, etc.)

- Assign the information case to yourself (or team), Synctera’s Compliance team member, and the bank after selecting “Submit Request” button

- Review and analysis of the rule change request to be completed by Synctera’s Compliance Operations team (Estimated Time to complete: 1-2 business days depending on number/complexity of the rule changes)

- If applicable, provide feedback/suggestions within the information request case. Additional meeting if needed.

- Bank approval is dependent on the rule changes and resources. (Estimated time for bank approval: 1 to 3 business days)

- After bank approval, the approved rule change(s) is configured, tested and published in the production environment by Synctera.

- The completion of the rule configuration(s) will be communicated to your team and the bank via the submitted information request case.

- Once configuration is complete, the Compliance team will upload the updated rules strategy document in the information request case for reference.

- Synctera will mark the case as “complete”.

FAQs

What is needed in the information request case if a user wants to make a transaction that is above the limit for a one-time transaction?

What is needed in the information request case if a user wants to make a transaction that is above the limit for a one-time transaction?

How can we escalate an information request case for a user that needs to make the transaction ASAP?

How can we escalate an information request case for a user that needs to make the transaction ASAP?

We have a select few users in our program that will have different limits than the general users, how can this be accomplished?

We have a select few users in our program that will have different limits than the general users, how can this be accomplished?

Do we still need bank approval if we want to utilize Spend Monitoring for those select users?

Do we still need bank approval if we want to utilize Spend Monitoring for those select users?

Do we need bank approval if we want to remove a country that is listed in the auto decline list?

Do we need bank approval if we want to remove a country that is listed in the auto decline list?

Do we need bank approval if we want to reduce or place further restrictions on specific rules?

Do we need bank approval if we want to reduce or place further restrictions on specific rules?

We’re in the post launch stage now but we will be launching a new product (e.g. Smartcard), do we still need to go over the rules strategy with the compliance team?

We’re in the post launch stage now but we will be launching a new product (e.g. Smartcard), do we still need to go over the rules strategy with the compliance team?

What if we are to launch with the default limits, do we need bank approval on the default limits?

What if we are to launch with the default limits, do we need bank approval on the default limits?

Does the bank need to approve every rule changes?

Does the bank need to approve every rule changes?

Where can I submit a ticket if a fraud rule is not working as intended?

Where can I submit a ticket if a fraud rule is not working as intended?

Do limits include the declined transaction amount and/or count in the total?

Do limits include the declined transaction amount and/or count in the total?

I don’t understand a rule or rule(s). Where can I find more information about a rule or multiple rules?

I don’t understand a rule or rule(s). Where can I find more information about a rule or multiple rules?

Do I need to submit a zendesk support ticket if I want to increase a hard limit temporarily due to a fraud case?

Do I need to submit a zendesk support ticket if I want to increase a hard limit temporarily due to a fraud case?

Do I need to submit a zendesk support ticket if I want to increase a hard limit permanently?

Do I need to submit a zendesk support ticket if I want to increase a hard limit permanently?