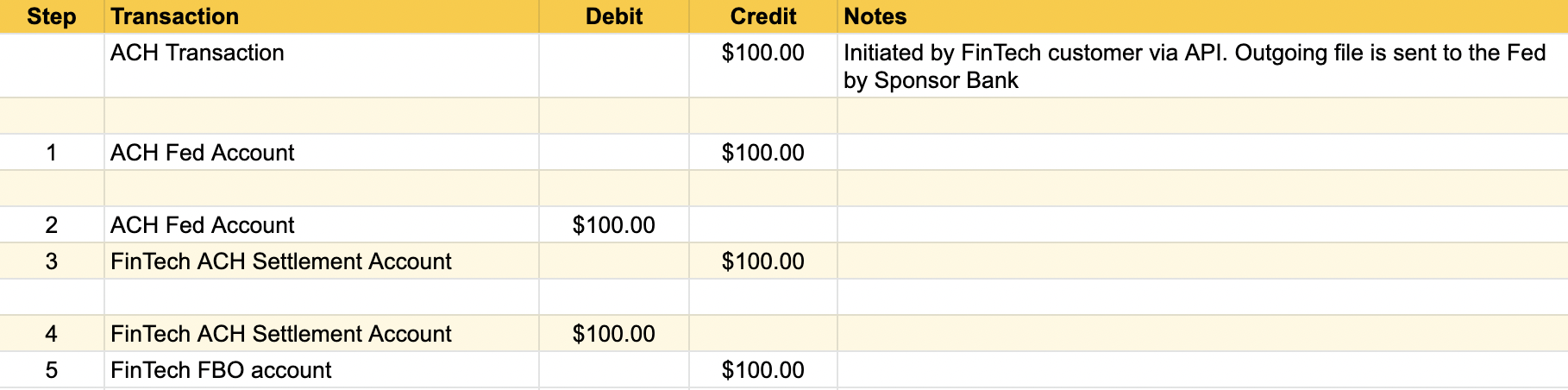

High-Level Accounting Flow for ACH

Accounts definition:

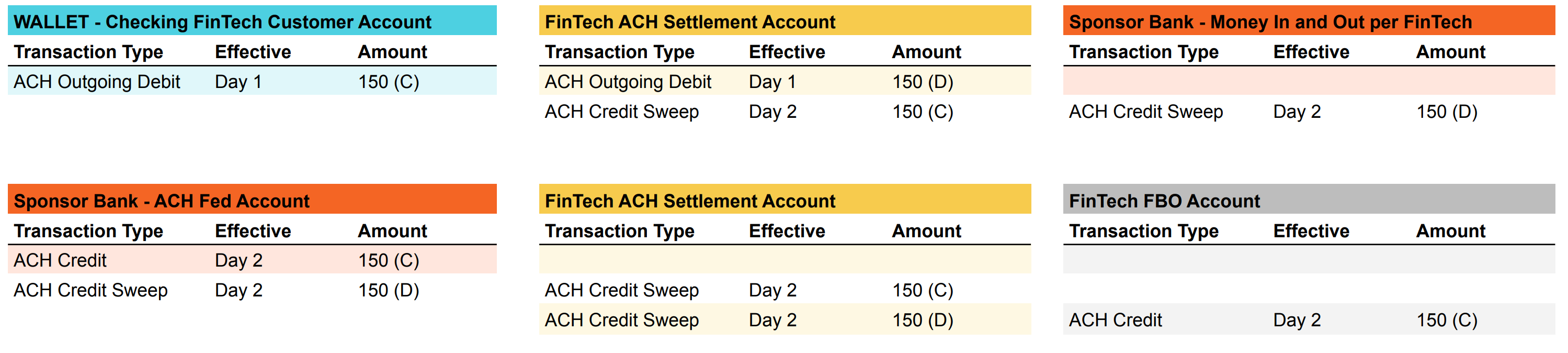

Synctera Ledger:- FinTech’s Customer Account: This is the FinTech’s customer account. ACH Credit, Debits and Returns will be posted to the customer account.

- FinTech’s ACH Settlement Account: This account represents the ACH Settlement account, with ACH aggregated transactions for all the FinTech’s customer accounts. This account is used to track amounts to be settled with the Fed.

- Bank Money in and out per FinTech: This account the amounts owed or owe to the FinTech’s FBO account (at the Sponsor Bank) for ACH payments

- Sponsor Bank’s ACH Fed Account: This is the account in the Sponsor Bank’s Ledger to settle with the Fed. The FED will settle two payments daily ACH Credits and ACH Debits

- FinTech’s ACH Settlement Account: This account tracks the FinTech’s aggregated ACH Credits/ ACH Debits for the Day

- FinTech’s FBO Account: This account represents the aggregate balance for all of the FinTech’s customers at the time

High-Level Money Movements:

Day 1:- FinTech Customer originates ACH Debit for $150 via API in the Synctera ledger, as a result the FinTech’s customer account is credited and Settlement account is Debited

- Outgoing File is sent out to the network (Fed)

- Synctera Operations performs a sweep transaction with the aggregated value for all customer transactions from the settlement account to the ‘Money in and out account’ for day 1 that are effective for Day 1 or earlier

- FED Credits ACH Fed Account at the Sponsor Bank with the aggregated credits/debits for Day 1

- Sponsor Bank’s financial controller/ACH OPS login to the Synctera platform to see the ACH settlement account movements as well as the daily fund movement reporting

- Sponsor Bank debits/credits the FED settlement account and debits/credits the FinTech’s settlement account for the value of the credit/debit sweep transaction in the Synctera system - this value represents all the credits/debits for the FinTech to be settled with the Fed. If this does not match the settlement from the Fed, a reconciliation difference will exist that will need to be investigated based on the reconciliation function in the Synctera App

- After the Sponsor Bank moves all the Credit/Debits to the FinTech Settlement account, the Fed settlement account should be ‘zero’ and it is balanced against the FinTech settlement account

- From the Settlement account money is moved manually in the Sponsor Bank’s Banking Core to the FinTech FBO account - now the FinTech is balanced for ACH